Brazil is currently in the midst of one of the largest fiscal changes in decades. The tax reform constitutes more than just legislative change; it modifies the entire framework for the calculation, collection, and auditing of taxes, all of which affect businesses from several perspectives in diverse economic sectors.

For many organizations, this entire shift represents ambiguity, complex structural adaptation, and fear of fiscal risk. Others may see clear opportunities for competitive advantage.

The reality of dealing with the tax system in Brazil has always been one of effort, technical specialization, and continued learning.

Brazil is internationally known as one of the world’s most complicated tax systems, incorporating a tax structure that requires more preparation, more preparation than almost any other market.

The reform accelerates this reality, and the importance of adaptation is critical for survival. Organizations that regard the change only as an obligation usually respond slowly and incur high costs.

Organizations that seek to change strategically anticipated changes and possibly adapt will mitigate risk and create real operational value.

This is where the Product Marketing Manager assumes a central role. The PMM will need to position the tax reform as an opportunity to reposition solutions, enhance the value proposition, and lead the market through the noise.

The organizations that are able to interpret and communicate the impact during significant regulatory changes are those that will move forward. The PMM becomes the translator of complexity into simplicity, uncertainty into confidence, and regulatory change into a narrative to drive decision-making.

This article dives further into this complex Brazilian environment; we believe this analysis can produce relevant insights for PMMs in other countries with inherent regulatory change, since strategies born in arguably one of the most complex tax regimes in the world can often be extrapolated to other markets.

We will also show how regulation can shift from defensive maneuver to competitive differentiator when one considers enterprise management software as a primary driver and how the right combination of thinking through technology and prepared preparation can elevate business readiness for change.

The objective is to demonstrate practicable routes for PMMs to move from a complex situation to tangible competitive advantage.

When regulation becomes strategic territory

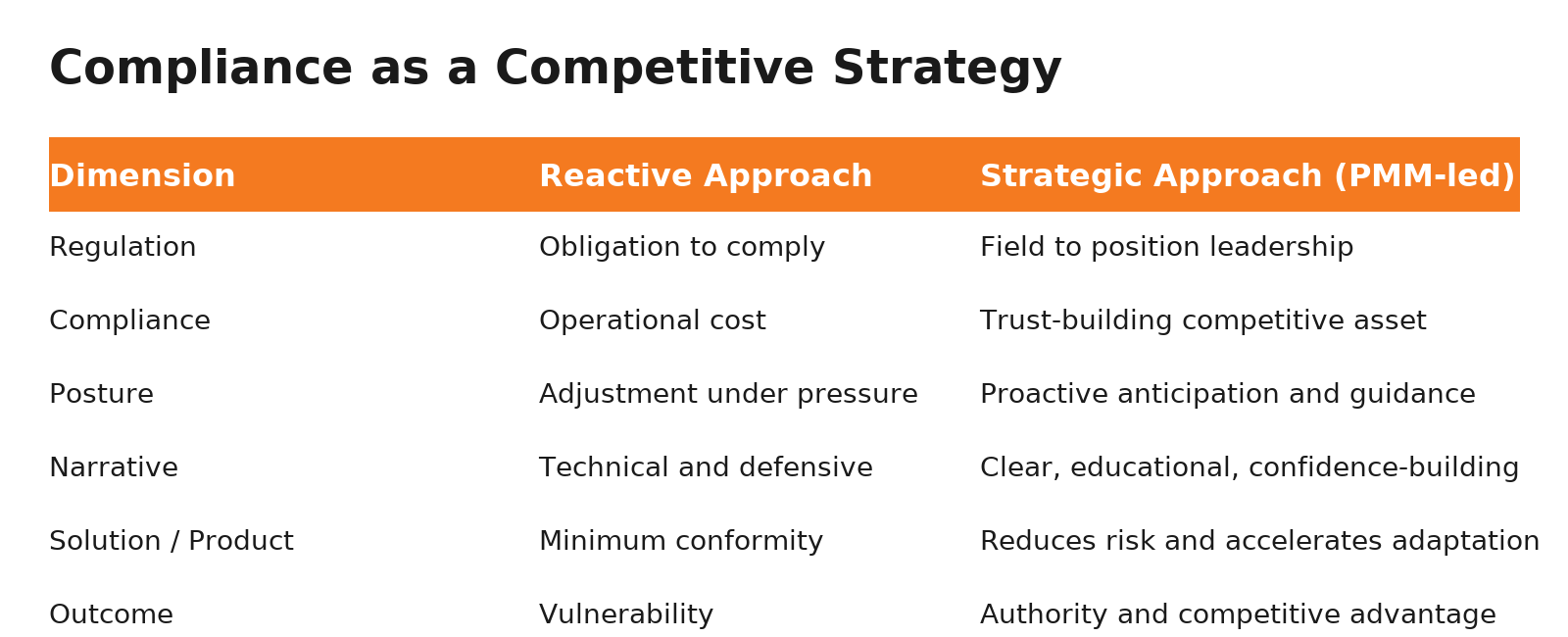

Regulatory changes are typically approached as an adaptation exercise. A company receives a regulation, the processes are modified, the systems are adjusted, the company adapts, and it is business as usual.

This is the usual paradigm. However, if the structural impact of the change is systemic, as it was with the tax reform, this reactive posture leaves value on the table.

Regulation goes from being a legal obligation to a space for competition. The early movers that understand the impact of the change, communicate with clarity, and provide protection to their customers, build authority.

And, in this context, authority is not just reputation. Authority leads to purchase preference, lower churn, and stronger government partnerships with key decision-makers.

The PMM plays a central role in this dynamic. This is the professional who takes the time to observe and understand the lay of the land, translates the impact of the change, and builds a value narrative from it.

This is beyond “we are compliant.” This is about positioning the solution as the bridge to reduce risk and complexity and assist the customer in making an informed decision at a critical time.

The strategic dilemma is not “is this product compliant?” The dilemma is “how do we demonstrate that using our product reduces the cost of adaptation, hastens the transition, and improves the customers’ operating performance?”

The company addressing this consistently establishes a strong impression; they are not just keeping pace with the change, they are leading it.

Case – Building leadership in a hostile environment

To identify what it means for regulation to be transformed as a strategic advantage, let’s examine the case of a Brazilian company that develops ERP software for the retail business.

This is a company that is well known in the national market as it serves retail chains of different sizes with a multifaceted operation that encompasses everything from inventory management to pricing, tax control, and integration with points of sale and digital channels.

In Brazilian retail, operations are already complicated by nature. Low margins, high turnover, extensive item catalogue, complex taxation to account for, and the ever-present competitive pressure require accuracy and efficiency.

Well before the tax reform, the consumers/service providers’ marketplace demanded speed/response time, standardized operations, reduced losses, and consolidated visibility of business data.

With the announcement of the tax reform, the environment has become even more complicated. The adjustment in the tax structure places the fiscal matter front and center in the strategic decision journey.

The consumer/service providers are asking how to adjust their tax parameters, how to continue operating, and how to not incur tax risks during the transition at the end of the year.

Within this environment, the Product Marketing Manager (PMM) operates as the primary intermediary nexus among product, market, and regulation, as they transform tax requirements into competitive advantage.

The company is tackling a dual problem:

- Making sure the compliant product is ready for the new law

- Clearly and simply educating the market, while eliminating noise, ambiguity, and pressure on support teams

The important consideration is that the company does not view the reform as a mere regulation change to be met as a technical update to its compliant product. It understands the opportunity of being the leader in interpreting the reform and taking its customers through the change as a competitive advantage.

The attitude shifts from “we are here to comply with regulations” to “we are the point of reference in a time of confusion and uncertainty.”

The company also participates in committees and working groups with the government in the development of the tax reform to enhance its ability to anticipate impacts and solidify its position as a national reference.

The company is trying to position itself not only as an ERP provider, but as a proactive contributor to the future of tax management in Brazil.

From this context, we can see how the strategy plays out in real life, how the narrative is built, and how technology – including Artificial Intelligence – renders customer preparedness more quickly, always influenced by the strategic insights of the PMM.

From fiscal obligation to competitive differentiator: Storytelling as a value strategy

As the tax reform intensifies in the national conversation, the market has “turned defensive” again. Most software companies will relay risk, urgency, bureaucracy, and the need to “update your systems so you don’t fall out of compliance.” The communication will be technical, cumbersome, and often very reactive.

This ERP company has an alternative model.

Before communicating ANY details: screens, parameters, or configuration guides, the PMM is focused on building a UX narrative to reposition the reform as not a reform, but rather a milestone that reorders processes and improves the results – gainfully messaging clarity, guidance, and leadership as opposed to fear.

The core positioning of the product is clear: it’s not just compliance with the new legislation, but being ready before anyone else.

This notion moves the communication construct:

- Those who assess will incur less operational disruption during the year transition.

- Those who redesign their records first will ensure operational fluidity.

- Those who acclimate to the changes will realize tax opportunities.

- Those who begin prepared will reduce dependency on help during a stressful period.

The ERP ceases to function only as a tool: it operates as a trustworthy compass in guiding the transition. The organization serves as interpreter, translator, and navigator, while the PMM assures that the narrative turns compliance into competitive advantage. This leads to three vital outcomes:

- Authority: the organization moves from being reactive to being the leader of the narrative.

- Trust: the client regards the organization as a reference, not simply a commercial operator.

- Preference: because the issue becomes a true concern or specifically designed to be a concern, the organization is already lined up front.

The narrative reinforces: the reform is not merely about taxation – it is about positioning your business for the next retail cycle. Those who move first win.

In effect, the organization rewrites the narrative through adopting this work style; in change, it will stop talking about adaptation only and talk about opportunity.

Legislation stops being a cost center and becomes a vehicle of competitive differentiation, with PMM leadership creating the sense that it matters to the market.

The turn of the year and artificial intelligence as a preparation accelerator

The crucial moment in this situation is the start of the year when the new rules would go into effect, and customers would need to revisit records, change parameters, and justify tax activity.

Any of these processes could jeopardize the retailer’s process: checkout queues, stock-outs, price miscalculations, unrejectable invoices, or even simply a software error could create a chain reaction.

The teams are aware of the pressure. The system will be set up technically, will have solid documentation, and the configuration workflows will be established. Nevertheless, it is understood that many customers will likely request assistance at the same time, and the support inquiry volume may rise as well.

The strategic choice of going with an AI solution is not for a neat future concept; rather, this is simply the vehicle to trigger your AI-enabled assistant to guide the customers in understanding the tax reform.

It would be AI-enabled, tailored to the ERP, and trained with:

- Tax model frameworks

- Product documentation

- Operational manuals

- Real client Q&As

- Configuration examples by operation type

- Continuous updates as things are defined

The assistant is essentially the first line of support for questions such as:

- “Which table do I need to review to change the tax for this item?”

- “How do I set up interstate operations with the new rule?”

- “Which report presents the effects of the new calculation on margins?”

All are performed without any lag time waiting for a human analyst. This ease of acceptance is aided by the narrative that has already been formed: the AI is an extension of the commitment to guiding customers before, during, and after the transition.

Potential outcomes are:

- Fewer spikes in support tickets

- Less risk of operational breakdown during the transition

- More confident, better-prepared customers

- Quicker and more accurate decisions made by operations groups

The message to the market is clear: The company not only knows the reform – it guides the transition.

AI is not “the product,” but the bridge between technical complexity and practical execution.

For the PMM, this highlights something essential: technology only creates competitive advantage when it solves the right pain at the right moment.

Risks of not being prepared: impacts on operations, support, and compliance

While the story emphasizes the merits of readiness, the downside of this is the cost of inaction. When a retail company does not prepare for a tax change of this size, which affects its operations, the consequences happen quickly and across many layers of the business.

The first effect is often on operations. Any one misconfigured tax parameter can block invoices from going out, change margins without warning, freeze the POS, and create inventory discrepancies.

When you factor in the speed of retail, where minutes of interruption cause lines, lost sales, and customer displeasure, things are moving very fast.

The second impact is felt by the software provider’s support team. The first few weeks after the change is enacted, support tickets tend to go up significantly, because customers do not understand how to configure tax in the system, or how to undertake the new tax regulations.

Human support, even with structured teams, does not manage to scale at the same rate as operational consequences.

The third layer is the most crucial: tax compliance. A seemingly simple issue, like an error in tax code, can generate audits, penalties, and operational ramifications. Brazil usually has a short time frame for correction, and accountability is high.

The unprepared company is going to face a number of not only technical complications, but also direct financial complications.

In this ongoing case, the strategy of anticipatory narrative and the use of artificial intelligence, or PMM leadership, usually mitigates this situation at scale.

Clear, guiding narrative with anticipatory support tools reduces the natural friction of change. Rather than a peak of disjointed support tickets, a more orderly transition takes place with a more autonomous adjustment of processes.

For the PMM, this is clear learning:

In a regulatory change scenario, a truly differentiating factor is not just a product, but the combination of preparation, strategic narrative, continuous education, and intelligent support that turns compliance into a competitive advantage.

The company that offers guidance will avoid crises. The company that waits and reacts loses recovery.

Conclusion and final recommendations

The case being analyzed demonstrates that if the PMM performs the activities encapsulated by the NC, regulation ceases to be merely an obligation and shifts to a strategic opportunity for the firm.

Anticipation, clarity of direction, and a savvy use of technology not only reduce risks but also create real competitive advantage for the firm and its customers.

The tax reform put the market in an unavoidable and challenging situation, while also creating space for a smart repositioning.

In the instance analyzed, the software firm did not wait for the change, studied the impacts, led the narrative, translated the complexity, and positioned itself as an authority at the national level on the subject.

This action positioned the ERP as a strategic asset in the retail adaptation process and reinforced its authority during a period defined by massive uncertainty.

The results are evident, with customers better prepared, support teams less stressed, and an expanded sense of value perceived.

The firm has moved from being perceived as a system provider to being perceived as a partner in moving the customer forward. The use of Artificial Intelligence also reinforced the transition by expanding the firm’s ability to provide directions and reduce operational risks.

Key points:

- Regulations as potential: fiscal shifts provide a means for differentiation, rather than barriers.

- Strategic narrative: the right story turns obligation into opportunity.

- Continuous education and support: this works to build trust, reduce friction, and create adoption.

- Timing and leadership: when anticipating, we define the messaging the market will follow.

- Compliance as competitive advantage: understanding context, communication strategy, and real proximity to the customer.

In regulatory scenarios of transition, compliance will no longer be a cost, but a competitive advantage. For PMMs, this means, when guided with strategy and vision, regulation is the vehicle to transform complexity into market share.

When executed, the PMM does not just lessen the impact of change. It raises the perceived value of the input, improves its market position.

Regulation does not have to stymie innovation. With strategy, it can be the catalyst for distinguishing those who react from those who lead.