Pricing a product isn’t about picking a number that “feels right.” In 2026, successful product teams calculate pricing using cost data, customer value, market benchmarks, and continuous testing.

Whether you’re launching a new product, adjusting pricing due to rising costs, or trying to improve margins, this guide breaks down exactly how to calculate your product selling price step by step — with formulas, examples, and practical guidance for SaaS, B2B, and B2C products.

By the end, you’ll know how to price your product confidently, competitively, and profitably.

What is a product selling price?

A product selling price is how much a customer pays for a product/service. Prices vary depending on how much customers are prepared to pay, the amount of money the seller is prepared to accept, and how competitive the price is when compared to other businesses.

Why getting your product price right matters in 2026

Rising customer acquisition costs, AI-driven competition, and increased price transparency mean pricing mistakes are more expensive than ever.

In 2026, product pricing decisions are influenced by:

- Higher buyer expectations around value

- Faster competitor price changes

- AI-powered price comparison tools

- Pressure to balance growth with profitability

That’s why modern pricing isn’t static – it’s calculated, tested, and revisited regularly.

How to calculate the price of a product (step by step)

Step 1 – Calculate your total costs

Start by identifying all costs required to deliver your product:

Direct costs

- Manufacturing or development

- Hosting or infrastructure

- Packaging and distribution

Indirect costs

- Marketing and sales

- Customer support

- Product management and overheads

Your total cost per unit is the foundation of any pricing calculation.

Step 2 – Define your target margin

Next, decide how much profit you need to make on each sale.

Typical gross margins by product type:

- SaaS: 70–90%

- Digital products: 80–95%

- Physical products: 30–60%

Your margin should reflect your business model, growth stage, and market expectations.

Step 3 – Apply a pricing formula

The most common starting point is cost-plus pricing (click here for more formulas):

Example:

If your total cost is $40 and your target margin is 60%:

$40 ÷ (1 − 0.6) = $100 selling price

Step 4 – Validate against the market

Once you calculate a price, compare it against:

- Competitor pricing

- Customer willingness to pay

- Perceived value of your product

If your price is significantly higher or lower, reassess your value proposition — not just the number.

Step 5 – Test and adjust over time

Pricing is not a one-time decision.

Regularly review pricing based on:

The most effective pricing strategies evolve with your product and customers.

Product pricing formulas (with examples)

Product selling price formula

The simplest way to calculate your product selling price is by adding a profit margin to your cost price.

Formula:

The cost price is the amount paid to produce or acquire the product.

The profit margin is the percentage added to ensure profitability.

This method is often used as a baseline and should be validated against customer value and competitor pricing.

How to calculate the average selling price

Before setting your own price, it’s important to understand the average selling price (ASP) of similar products in the market.

Formula:

Example:

If a market generates $5,000,000 in revenue from selling 10,000 units, the average selling price is $500.

If you’re launching a new game console and want to position it as a premium product, this benchmark can guide your pricing. You may choose to price your product at $550-$600 to reflect a higher perceived value and differentiate from competitors.

How to calculate product selling price by unit

If your business purchases inventory in bulk, calculating the selling price per unit ensures accuracy and consistency.

To calculate product selling price by unit:

- Calculate the total cost of all units purchased

- Divide the total cost by the number of units to determine the cost price per unit

- Apply your chosen pricing formula to calculate the final selling price

This approach is especially useful for physical products, wholesale businesses, and ecommerce brands.

Tap into the six steps to the perfect pricing strategy.

👉 Download your free copy

How to calculate the perfect product selling price: 5 key pricing models

There are multiple pricing models you can use depending on your product type, market, and growth goals. Below are the most common pricing models and when to use them.

Freemium pricing model

The freemium pricing model offers customers a free version of a product, with the goal of converting them to a paid plan over time.

A common example is Spotify, which provides free access with limitations such as ads and restricted features, encouraging users to upgrade to a paid subscription.

Freemium pricing is designed to reduce friction, increase adoption, and build a large user base.

When should a freemium pricing model be used?

Freemium pricing works best for digital products targeting large markets. To succeed, you must:

- Deliver strong value in the free version

- Clearly differentiate paid features

- Avoid giving away core value for free

- Sustain costs until users upgrade

Careful data analysis is essential to determine which features remain free and which drive conversion.

Tiered pricing model

Tiered pricing allows customers to choose between multiple pricing options based on their needs.

Common tiers include:

- Free or freemium

- Individual

- Team or family

- Student or discounted plans

This structure enables customers to self-select the option that best fits their use case and budget.

When should a tiered pricing model be used?

Tiered pricing is ideal for digital services with diverse customer segments. It helps businesses maximise revenue while appealing to different willingness-to-pay levels.

Flat-rate subscription pricing

With flat-rate pricing, customers pay a fixed recurring fee in exchange for a defined set of features or services.

A typical example is a mobile phone plan, where users pay a monthly fee for a specific allowance of data, minutes, and texts.

When should flat-rate subscription pricing be used?

Flat-rate pricing works best for:

- Products with limited feature variation

- A clearly defined target audience

- Simple value propositions

It’s easy to understand but offers less flexibility for upselling.

Bulk (volume) pricing model

Bulk pricing reduces the unit price as purchase volume increases, incentivising customers to buy more.

Example:

A company may charge $10 for one item, but reduce the price to $8 per unit when five items are purchased, creating clear savings for the buyer.

When should bulk pricing be used?

Bulk pricing is commonly used in B2B, wholesale, and manufacturing, where larger order sizes are standard and cost efficiencies increase with volume.

Market-based pricing

Market pricing sets product prices based on supply, demand, and competitor pricing rather than internal cost structures.

This model is often used by industries with high competition, such as:

- Consumer electronics

- Automotive

- Streaming services

When should market pricing be used?

Market pricing is effective when your product closely resembles competitors’. To succeed, strong positioning and messaging are essential to justify your price within the market.

Types of pricing strategies

Product marketers use different pricing strategies depending on their market, product maturity, and competitive landscape. Below are the most common pricing strategies and how they work in practice.

Common pricing strategies include:

- Competitor-based pricing

- Cost-plus pricing

- Value-based pricing

- Dynamic pricing

- Penetration pricing

- Price skimming

- Target costing

While cost-plus pricing is one of the simplest methods, target costing is often used when pricing decisions are heavily influenced by the market.

What is target costing?

Target costing is a pricing method where the market price determines the maximum cost a business can afford to produce a product.

The Chartered Institute of Management Accountants defines target costing as:

“A product cost estimate derived from a competitive market price.”

With target costing, pricing decisions are influenced by factors such as:

- Market competition

- Product similarity

- Customer switching costs

- Price sensitivity

Rather than adding a margin on top of costs, businesses work backwards from the price customers are willing to pay.

Example: How to price a product using target costing

Imagine you sell customised football jerseys and the average market price is $200.

- Average market price: $200

- Target margin: 50%

- Target cost: $100

This means the maximum cost to produce each jersey is $100. Any cost above this reduces your margin or makes the price uncompetitive.

How to determine an appropriate margin

There’s no single “correct” margin for every product, but many businesses aim for a 40–50% margin as a baseline.

Another simple approach is the price multiplier method:

- Multiply total costs by 2 for a 50% margin

- Multiply total costs by 3 for a 67% margin

If your product is highly differentiated or delivers unique value, higher margins may be achievable.

What is cost-plus pricing?

Cost-plus pricing calculates a selling price by adding a fixed profit margin to total costs.

Example:

If a product costs $60 to produce and the target margin is 30%, the selling price would be $78, generating an $18 profit.

This pricing strategy is most commonly used for physical products, where material and production costs are easier to quantify.

For SaaS products, cost-plus pricing often relies on estimated inputs such as salaries, development time, and infrastructure, which can make accuracy more difficult.

Pros and cons of cost-plus pricing

Pros

- Simple to calculate

- Ensures profitability if costs are controlled

Cons

- Ignores competitor pricing

- Doesn’t account for customer willingness to pay

- Encourages cost inefficiencies

- Makes frequent price increases more likely as costs rise

Because this model is inward-looking, it can lead to overpricing or missed revenue opportunities if used in isolation.

Differences between cost-plus pricing and target costing

The key difference between cost-plus pricing and target costing is where pricing decisions begin.

- Cost-plus pricing starts with internal costs and adds a margin

- Target costing starts with the market price and works backwards

Target costing is especially useful in competitive markets where customers have many alternatives and pricing flexibility is limited.

In contrast, cost-plus pricing may work better in niche markets or where costs are stable and competition is low.

How to calculate gross profit margin

To calculate your company’s gross profit margin percentage, subtract the cost of goods sold (COGS) from the net sales (gross revenues minus returns, allowances, and discounts).

Then, divide this figure by net sales, and this will calculate the gross profit margin as a percentage.

Why is profit margin important to investors?

Investors are interested in your net profit margin because this allows them to assess if your company is generating enough profit from your sales.

When you’re calculating your net profit margin, it’s important to consider overhead costs and fixed costs. These cover raw materials, salaries, insurance, utilities, etc. have been factored into the equation.

Business owners need to take into account that irrespective of whether you’re a small business/startup or an established enterprise corporation, the net profit margin is one of the key cogs in your overall financial well-being.

Things to consider when pricing your product

Multiple factors will influence the pricing model you choose to apply when deciding on the selling price of a product.

For example, if you’re holding an end-of-season sale to clear stock, you’ll likely use a discount price model to introduce a lower price.

Similarly, factors such as sales volume and labor costs will also influence your product’s price, and different prices are often used depending on geographical location.

Taxes, cost structures, market needs, and exchange rates are likely to have a say in the price of your product in international markets. This often means the exact same product will have a higher price in location A than in location B.

Whether you’re a solo entrepreneur, an e-commerce business, or part of a large-scale company, you need a pricing strategy that’ll give you the right price for your product.

Don’t forget to factor in variable costs when deciding on the price of your product; it’s a simple way to ensure you don’t alienate some segments of your audience.

If you’re unsure whether you’re priced excessively when compared to similar products, don’t be afraid to use a pricing calculator.

Pricing calculators are a great resource for helping business owners establish if their sales price is fair and meets the expectations of the clientele.

Silvia Kiely Frucci, Product Marketer of the International Segment of Wolters Kluwer, shared five lessons she’s learned when pricing products during her career:

1. Follow the process, but don’t be bound to it

Pricing is a complex matter, and it cannot be driven just by qualitative insights. Creating a framework around the various pricing work streams is essential to getting things done.

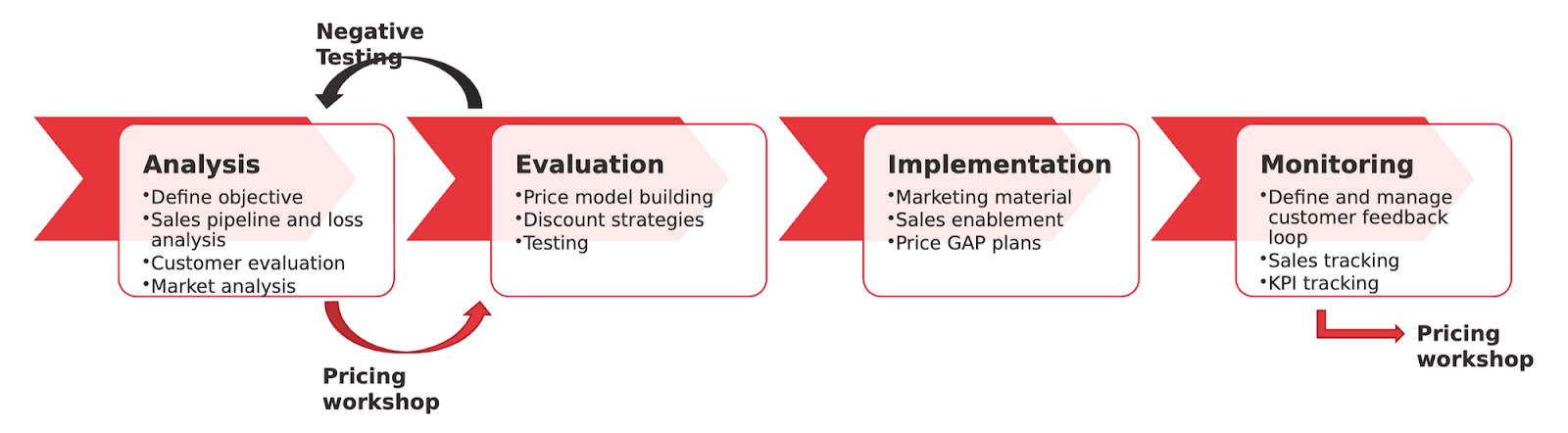

For the past two years, I have used the model below as a guideline:

Even if it looks like a linear process, milestones, and decisions are not always linked to the stage that the process suggests they should be dealt with.

For example:

- Relevant competitor information can be found after price testing with customers.

- The initial customer segmentation must be re-evaluated when new qualitative insights have emerged during a pricing workshop.

It’s important to always keep an open mind during the process to make sure your pricing output reflects the market needs.

2. Pricing is a team effort

Product marketers are often responsible for pricing, but the process doesn’t have to be a single-handed decision.

Pricing workshops are the perfect ground to involve all the key influencers to discuss around the table. Product, sales, marketing, customer engagement, project management, and Business Unit Directors are all stakeholders in the success of the pricing strategy: they all hold a unique perspective on products, customers, and markets, and they all have very different KPIs around success.

Creating an open dialogue is the best way to hear everyone’s point of view and find a common strategy.

3. The perfect pricing structure is a myth

In the past, I have built different pricing models: some were cost-plus only, others heavily relied on competitor pricing insights, and some were value-based.

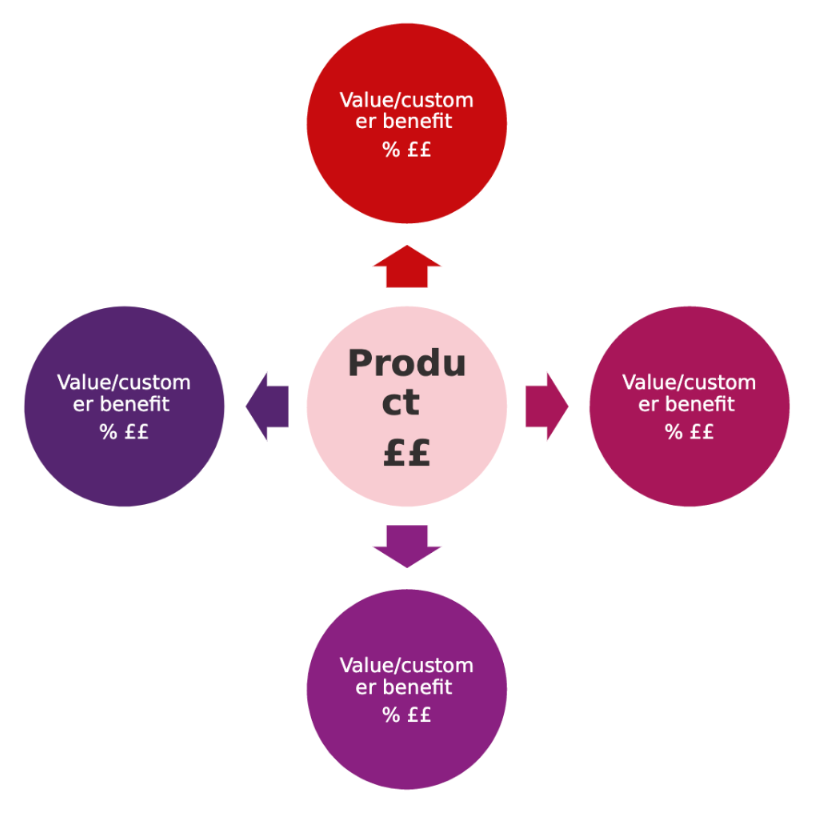

There is no doubt to me that value-based pricing is the most successful way to price products, both in the physical and SaaS space.

Value-based pricing best practices often show a 3-tier option with tick boxes for product features/benefits. Although this output is very clear and simple for customers it cannot be applied to every product: some products are so complex and/or so customizable they cannot be easily deconstructed to create different versions.

It is more the case of displaying value to the customers using a complementary pricing model where the final price is built by attributing a monetary rate to each customer-recognized value.

This model could be used as a guideline for discounting by asking the simple question to your customers: “Which value do you want to drop for a cheaper price?”

4. Negative price testing is the best ground to re-evaluate your product value proposition

I find price testing one of the most complicated processes to plan. Is it best just to live test and look for customers’ behavior in response? How about creating customer panels before roll-out? Will you test on renewals or new business? The questions are infinite.

Whichever strategy you select for the product you are selling, make sure you create a clear way to capture customer feedback: define 1-3 items that will help you define customer product perception in response to your pricing and align it with your product value proposition.

Great pricing means the customers have understood your product the way you and your company see it.

5. Pricing is not just a number

Making plans to roll out the price to the rest of the company is as important as deciding the price itself.

One of the never-to-be-missed actions from the pricing workshop is agreeing on a clear strategy around sales enablement: In my experience, partnering with your marketing team at this stage is paramount; they will help you shape the message internally and to the customer.

How to generate profit

Companies have one thing in common: they all want to achieve their desired profit – without introducing a low price!

There’s no doubt a suitable product selling price plays a crucial role in helping them achieve these objectives.

In his presentation, How to Price for Growth and Profitability, Yannick Kpodar, former Global Director of Product Marketing at PayFit, outlined his step-by-step process to identify the best pricing strategy for company growth and profitability.

Ultimately, there’s no definitive answer on how to price a product, and as Phill Agnew, former Senior Product Marketing Manager at Hotjar suggests, it’s a complex area where many companies make mistakes.

You need to utilize a pricing strategy to drive cash flow. To do so, you’ve got to be clear on:

- The cost of producing your product

- The value of your services to your clients

- How much your customers have and want to spend

- The overall running costs of your business

- What critical costs need to be covered short-term (e.g. loan repayments)

- How your competitors price their products

Pricing needs to take every one of these principles into account to drive optimum profit. You may have to go through your business plan with a fine-tooth comb and consider factors such as brand development, team restructuring, etc. before you can draw a definitive conclusion.

Remember, your pricing strategies and product selling price are by no means definitive. You should continually assess your plan and make changes whenever something isn’t working as you anticipate. Your decision-making process can be dictated by simple metrics such as sales figures and churn rates.

How to measure the impact and ROI of pricing strategies

Implementing a new pricing strategy without proper measurement is like sailing without a compass. Thibault Oberlin, Senior Director of Product Marketing at PayFit (formerly at Google), advocates using the OKR (Objectives and Key Results) framework to track pricing effectiveness systematically.

Setting pricing objectives

OKRs combine qualitative objectives with quantitative key results. “Setting a qualitative objective or goal… that’s the what. And then you’re going to tie to these key results, usually from two to four or five, which are all the actions that combine together to help you accomplish this objective,” Oberlin explains.

For pricing strategies, effective objectives might include:

- Improve pricing competitiveness in mid-market segment

- Increase average revenue per customer through value-based pricing

- Reduce pricing-related churn by 25%

Defining measurable key results

Each pricing objective needs 2-5 specific, measurable key results. Examples include:

For competitive pricing:

- Win rate against main competitor increases from 35% to 50%

- Price positioning analysis shows movement from premium to competitive quadrant

- Sales cycle reduces by 15% due to clearer pricing advantage

For value-based pricing adoption:

- 60% of new deals use value-based pricing calculator

- Average deal size increases by 30%

- Customer satisfaction with pricing transparency improves to 8/10

For reducing pricing churn:

- Pricing-related cancellation reasons drop from 40% to 15%

- Successful price increase communications achieve 85% retention

- Grandfathering policies reduce churn impact by 50%

Cross-functional alignment

Pricing OKRs must align across teams. Sales needs visibility into pricing performance for coaching, customer success requires churn indicators for intervention, and finance needs revenue impact metrics for forecasting.

Create a pricing dashboard accessible to all stakeholders showing:

- Real-time progress against key results

- Pricing win/loss analysis

- Competitive pricing movements

- Customer feedback on pricing

Iteration based on data

Review pricing OKRs monthly, not quarterly. Pricing markets move quickly, and waiting three months to adjust can mean significant lost revenue. Use leading indicators like quote-to-close ratios and pricing objection frequency to predict lagging indicators like revenue and churn.

By implementing structured measurement through OKRs, companies can move from gut-feel pricing decisions to data-driven optimization that directly impacts revenue growth.

Resources to develop pricing knowledge

Courses

Product Marketing Certified: Core, PMA’s certification program, features 11 modules and 10+ hours of learning, with an in-depth section focusing on the essentials of pricing.

With on-demand, live and online, and team courses available, there’s an option to suit your preference, whatever your requirements. You’ll also get access to templates that’ll help you ensure the price of the product is suitable.

For more information, sign up for a live demo, discover what’s on offer, and ask any questions you may have.

Alternatively, register now, get certified, and enhance your practice with your newfound pricing knowledge.

The Pricing Certified: Masters certification is a comprehensive course directly on helping you learn how to choose the right pricing models, understand customer segmentation, and identify the ideal price point for your product or service.

Templates and articles

FAQs about product pricing

Q: What is the best way to calculate a product selling price?

A: The most reliable method combines cost calculation, target margin, competitor benchmarking, and customer value validation.

Q: How often should product pricing be reviewed?

A: Most product teams review pricing quarterly or after major product or market changes.

Q: Is cost-plus pricing enough in 2026?

A: Cost-plus pricing is a good starting point, but value-based pricing often delivers better long-term results.

Q: How do I calculate product selling price for a new product?

A: Start by calculating total costs, set a target margin, and apply a pricing formula like cost-plus or value-based pricing. Then validate against competitors and customer willingness to pay.

Q: How do I factor competitor pricing into my product price?

A: Conduct competitive analysis to find average prices, then adjust your pricing based on perceived value, differentiation, and target margin. Competitor-based pricing ensures your product remains competitive in the market.

Q: How often should I review my product pricing?

A: Ideally, pricing should be reviewed quarterly, or whenever there are major changes to costs, competition, or customer behavior. Dynamic adjustments help protect margins and maintain competitiveness.

Q: Can SaaS products use cost-plus pricing?

A: Yes, but it’s less precise than for physical products. SaaS teams often include development hours, salaries, hosting costs, and infrastructure when calculating total costs. It should be combined with value-based pricing for best results.

Q: What is value-based pricing and when should I use it?

A: Value-based pricing sets prices based on the customer’s perceived value of the product, rather than costs. It’s ideal for differentiated products, SaaS, or markets where unique outcomes justify higher prices.

Q: How can I calculate product selling price per unit for bulk inventory?

A: Divide the total cost of all units by the number of units purchased to get the cost per unit, then apply your pricing formula to determine the final selling price. This ensures consistent margins across inventory.

Q: What mistakes should I avoid when pricing a product?

A: Common mistakes include: ignoring competitors, underestimating costs, over-discounting, neglecting customer perceived value, and failing to adjust pricing over time.

Q: How can generative AI help with pricing decisions?

A: AI tools can analyze market data, competitor prices, and customer behavior to suggest optimal pricing ranges and test scenarios. They help reduce guesswork and speed up decision-making.

Q: What is the difference between average selling price and product selling price?

A: Average selling price (ASP) is the mean price of similar products in the market, while product selling price is the price you set for your product based on costs, margins, and strategy. ASP helps benchmark your pricing decisions.