The shift that redefined growth economics

Between 2019 and 2024, the mobile growth landscape underwent one of the most profound structural changes since the introduction of app stores.

With Apple’s ATT limiting attribution visibility and store fees consuming up to 30 % of every transaction, user acquisition models that depended exclusively on App Store traffic became economically unsustainable.

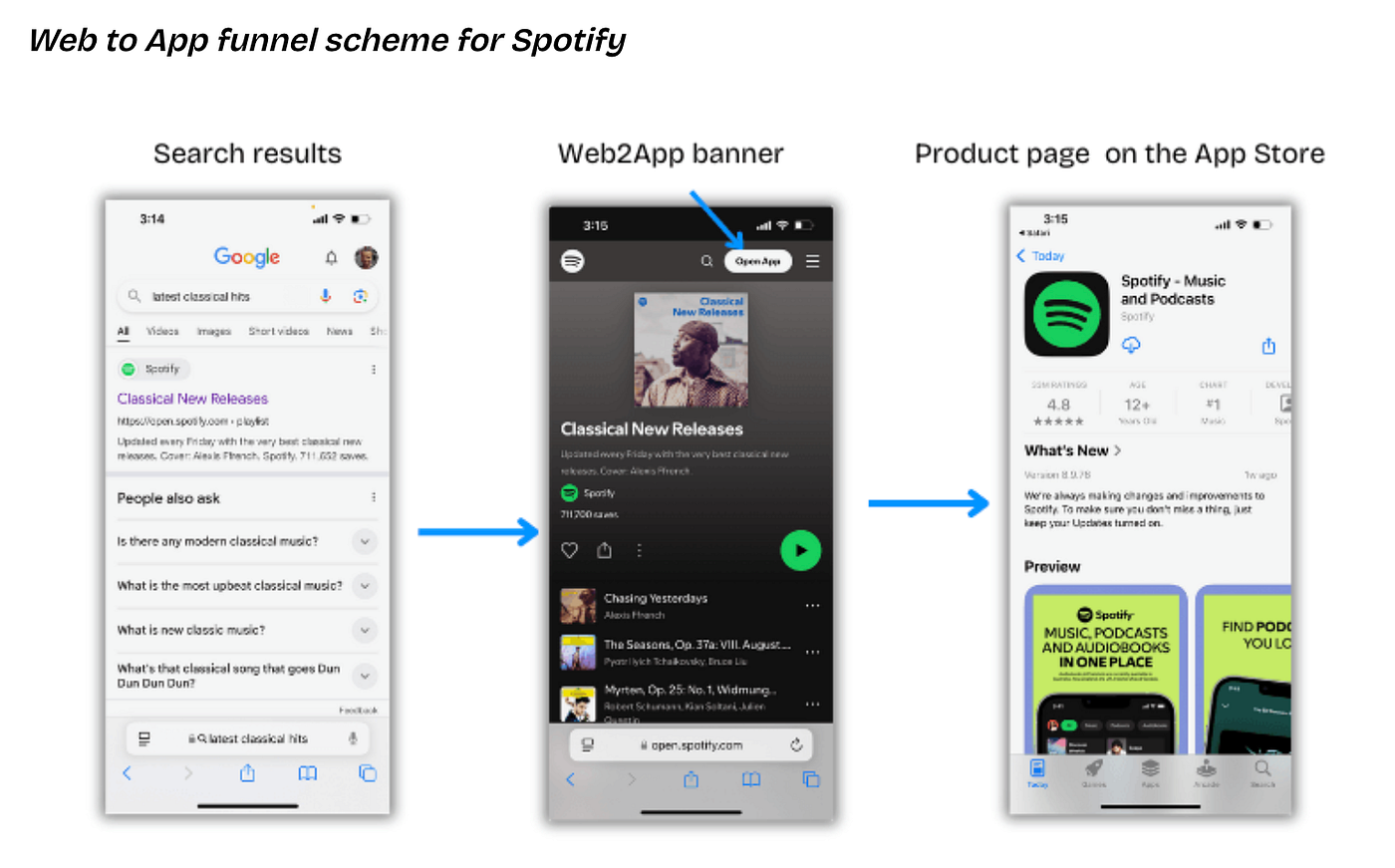

As Paddle notes in its 2024 report Web2App Funnel Fundamentals, the web has re-emerged as a primary performance layer: the bridge between ad impression and app retention. Similarly, Business of Apps highlights that the web “is often the first touchpoint for users, converting intent into installs at a higher retention rate than direct store visits.”

Today, the web funnel is not simply a design artifact. It is an economic model that shapes customer lifetime value (LTV), acquisition cost (CAC), and ultimately, unit economics. Yet across thousands of implementations, the same recurring mistakes continue to degrade performance and obscure growth potential.

The seven web funnel mistakes

After reviewing 10,000+ web funnels, I’ve found seven common mistakes that quietly drain revenue. Here’s how to avoid them.

1. The myth of originality

Many teams overestimate differentiation and underestimate behavioral convention.

Every vertical has established patterns of user cognition and expectation. Reinventing onboarding flows from scratch often produces novelty at the cost of comprehension.

According to Business of Apps, conversion-to-install rates rise 25–40 % when funnels mimic proven category structures.

Users do not reward originality — they reward clarity.

2. The static funnel fallacy

The web funnel is not a static artifact; it is a living experiment.

Without continuous optimization, even strong funnels degrade within weeks as audience behavior, platform rules, and ad algorithms evolve.

Paddle’s Web2App Funnel Fundamentals emphasizes the importance of ongoing testing enabled by full-funnel attribution visibility.

Teams that update at least one funnel element weekly maintain 32% higher conversion rates than those revisiting quarterly (internal Paddle and FunnelFox aggregates).

3. Narrative collapse

Borrowed fragments – a hero image from one brand, a quiz from another – often break the psychological flow of decision-making.

As FunnelFox notes, funnels fail not because of weak components but because the sequence of persuasion is misaligned.

In usability studies by Nielsen Norman Group (2023), discontinuity between page purpose and microcopy increased bounce rate by up to 39%.

Narrative continuity sustains attention. Fragmented design fragments trust.

context → relevance → value → action

When one screen changes, re-validate the sequence.

4. The length paradox

Empirical data suggests otherwise. Users abandon unengaging funnels, not long ones.

A well-structured multi-step journey can strengthen commitment by gradually increasing perceived ownership of the outcome.

Adapty reports in its App Funnels Analysis Guide that funnels embedding interactive elements (quizzes, personalization steps) convert 18 % better on average, even when the flow extends beyond five screens.

Engagement depth, not brevity, predicts success.

5. Checkout neglect

Checkout is where psychological friction peaks. It is also where revenue loss accumulates.

RevenueCat’s analysis, The Pros and Cons of Web-to-App Funnels, notes that web checkouts can reduce platform fees from 30% to 2–3% and improve conversion by up to 30% when localized payment options are offered.

The Baymard Institute (2024) estimates that 70% of online checkouts are abandoned due to unclear pricing, form friction, or limited payment choices. Each represents a preventable loss.

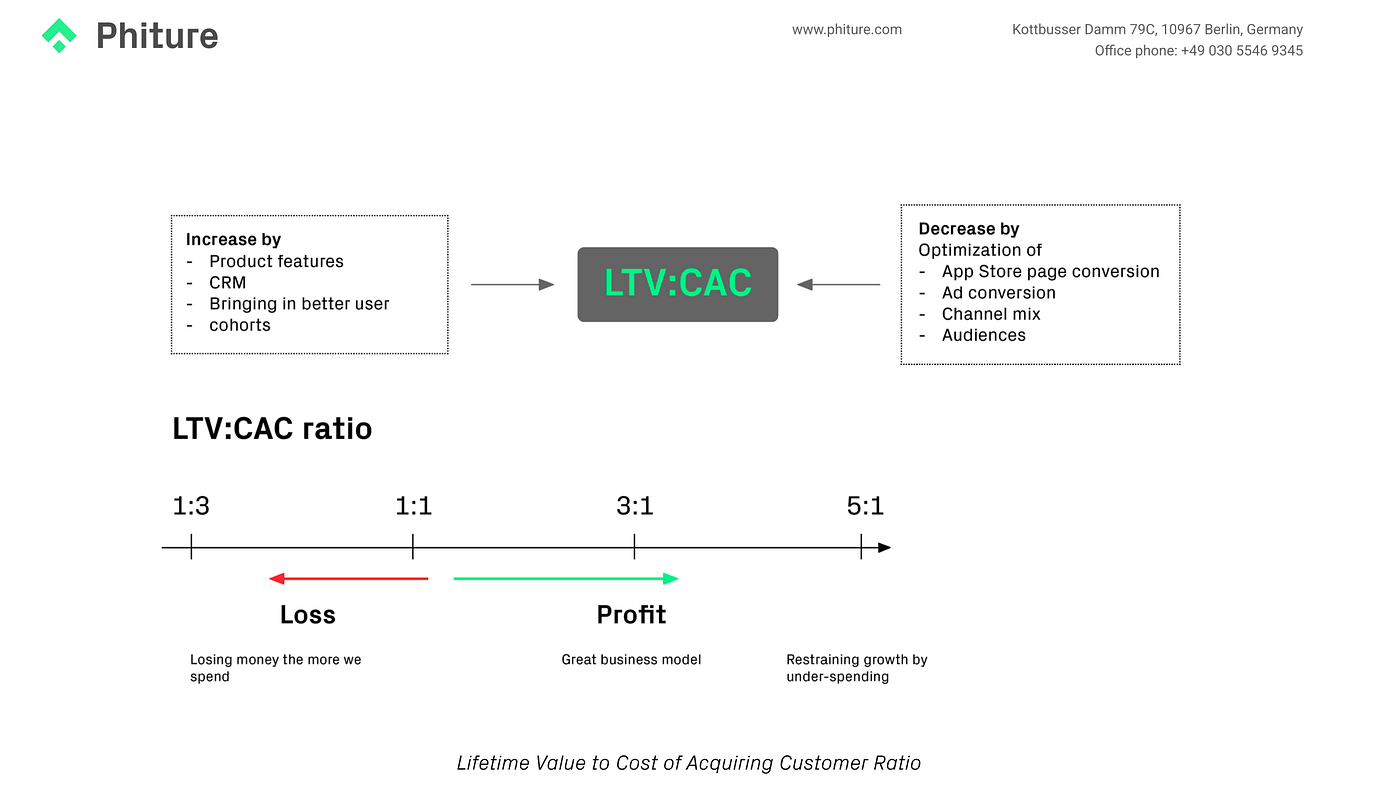

6. The missing LTV layer

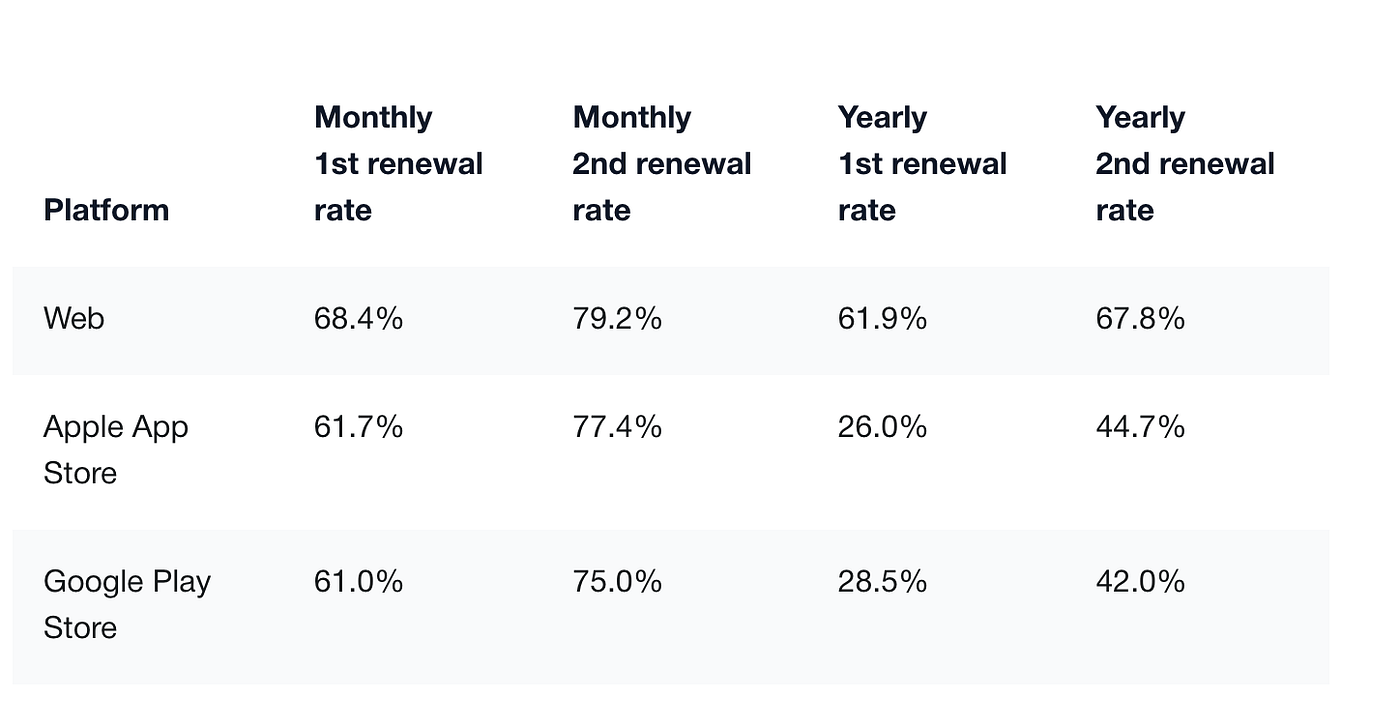

The most strategic advantage of the web2app architecture is its impact on LTV and CAC.

Web funnels give you attribution visibility, lower transaction costs, and richer first-party data – all of which compound to improve your LTV to CAC ratio.

Framework reference:

Phiture’s LTV/CAC model (below) demonstrates profitability equilibrium around 3 : 1 – the point where lifetime value triples acquisition cost.

- Paddle recommends tracking retention and LTV differences between web-acquired and app-acquired users.

- FunnelFox reports that web-to-app funnels yield up to 4× more actionable data, improving ad efficiency.

- Adapty’s retention cohorts show LTV improvement of 10-15% when web onboarding precedes install.

7. Ignoring web funnels entirely

Some teams still rely solely on App Store acquisition. That approach ignores the controllability, data integrity, and profitability of the web layer.

Historical context:

As GoPractice outlines, web-based acquisition experiments began around 2016 but accelerated after ATT in 2021, marking the “second wave” of funnel-driven growth.

Economic logic:

A custom in-house web funnel can require $200K+ and 8–12 weeks of development. No-code systems such as FunnelFox or Webflow Logic launch in <5 days for <$25 K.

The cost differential alone can determine whether a product achieves positive LTV/CAC payback within a fiscal quarter.

TL;DR

The web funnel is not an accessory to the app. It is the economic control panel of modern growth.

It unites product marketing, analytics, and monetization into a measurable engine that enhances both customer experience and capital efficiency.

Teams that understand this structural shift and avoid the seven systemic errors move beyond incremental testing toward strategic compounding.

In an era defined by tighter budgets and increasing data constraints, the path to profitability no longer runs through app stores. It begins, and increasingly ends, on the web.