Let’s be honest: financial forecasting isn’t the most glamorous part of running a PMO. But it might just be one of the most important. If you’re leading a project or portfolio management office, chances are you’ve felt the pain of trying to answer deceptively simple questions like: Are our projects profitable? What is our revenue estimate for this quarter?

And those questions usually come from a CFO or executive who needs an answer yesterday.

You’re not alone. In fact, “Financial Management and Forecasting” consistently ranks among the top challenges PMO leaders face. The culprit? Siloed data, disconnected tools, and planning that happens in spreadsheets rather than in real-time.

Let’s dig into why forecasting is so tough—and what you can do about it.

Why Financial Forecasting Feels Like a Guessing Game

At the heart of the challenge is visibility. Too often, financial data sits in one system (like your ERP or accounting tool), while project plans, resource allocations, and time tracking live somewhere else. Without integration, forecasting becomes a slow, manual, error-prone process.

Common symptoms we hear from PMO leaders:

- You’re constantly reconciling spreadsheets. Every forecast update turns into a fire drill.

- Actuals come in too late. By the time you realize a project’s off-track financially, the damage is already done.

- You’re stuck reacting instead of planning. Without a clear picture of future revenue or costs, it’s tough to guide strategic decisions.

Sound familiar?

What Good Looks Like: Integrated Financial Planning

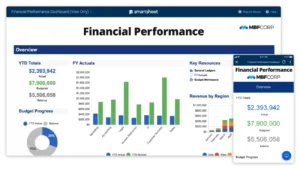

The goal is to move from reactive to proactive. That means bringing your financial and project data together into one clear, real-time view. When done right, integrated financial forecasting helps you:

- See project budgets, actuals, and forecasts side by side.

- Understand resource costs in context with project timelines.

- Reforecast quickly when things change (and they always do).

- Support executive decision-making with reliable, forward-looking insights.

Let’s break it down into actionable steps:

Step 1: Start with a Foundation of Clean, Aligned Data

Before diving into tools or automation, make sure you’re working from a single source of truth. That means:

- Standardizing how costs are captured (e.g., labor, materials, software licenses).

- Aligning naming conventions between Finance, PMO, and Delivery teams (yes, this matters!).

- Establishing a cadence for syncing actuals from your accounting system into your project tools—weekly or bi-weekly is ideal.

This alignment ensures that when you say “project cost,” everyone knows what’s included and what’s not.

Step 2: Use the Right Tools for the Job

You don’t need a full-blown ERP to get good forecasting. Many modern Project & Portfolio Management (PPM) or Professional Services Automation (PSA) tools offer solid financial features—budget tracking, cost rates, time tracking, revenue forecasting, and variance analysis.

Look for tools that let you:

- Track forecasts vs. actuals in real time

- Create scenario plans (what happens if we delay hiring that developer?)

- Allocate resources by cost and availability

- Tie financial plans to project milestones and deliverables

Tools like monday.com PSA, Smartsheet Control Center, or Planview AdaptiveWork can give you these capabilities without needing to overhaul your finance systems.

Step 3: Tie Forecasting to Resource Management

People are your biggest cost—and your biggest lever. If your resource planning is disconnected from your financial forecasting, you’re flying blind.

Align your forecasts with real-time resource allocations by:

- Assigning cost rates to resources or roles.

- Forecasting hours (or FTEs) across projects, not just tasks.

- Modeling what happens when workloads shift (i.e., when “Bob” gets pulled onto another initiative).

The key here is to forecast not just for the next sprint, but across the entire portfolio horizon—quarterly, semi-annually, or even for the fiscal year.

Step 4: Build a Rolling Forecast Cadence

Forecasting shouldn’t be a one-time event or something you scramble to do before the next executive meeting. Create a rolling forecast process—updating bi-weekly or monthly—that reflects changes in scope, timeline, or team availability.

A good forecast should feel like a living document, not a static spreadsheet that collects dust after it’s approved.

Pro tip: Include delivery leads in these updates. When project owners understand how their forecasts impact portfolio-level decision-making, they get more engaged (and more accurate).

Step 5: Tell the Story Behind the Numbers

Your leadership team doesn’t just want numbers—they want insights. Translate forecasts into plain language:

- Why are we over budget on this project?

- What’s the financial impact if we delay this initiative?

- Are we tracking toward quarterly revenue goals?

Adding simple visuals (burn rates, forecast accuracy trends, profitability by client or program) goes a long way. Use dashboards that surface exceptions and trends, not just raw data.

Final Thoughts: Start Simple, Then Scale

If all this sounds overwhelming, take a breath. You don’t have to go from spreadsheets to full automation overnight. Start by aligning one or two core systems, pilot a forecasting process with a few key projects, and expand from there.

And if you’re not sure where to start—or just want a second opinion—we’re here to help.

Let’s Get Your PMO Financially Fit

At Kolme Group, we’ve helped hundreds of PMOs and services teams modernize their forecasting practices—bringing finance, delivery, and strategy into better alignment. Whether you’re just getting started or looking to level up, we can tailor a solution that fits.

Reach out at ppmanswers@kolmegroup.com or drop us a message to talk shop.

You’ve got this. And we’ve got your back.

The post Why Financial Forecasting Trips Up So Many PMOs—and How to Fix It appeared first on Kolme Group.