Managing money effectively rarely happens by accident. As costs rise and financial goals multiply, having a clear budget plan becomes essential for staying in control. Rather than reacting to expenses month by month, budget planning helps individuals make intentional decisions, prioritize spending and align daily choices with long-term financial stability and personal peace of mind in modern everyday life.

What Is Budget Planning?

Budget planning refers to the structured approach used to evaluate income, anticipate expenses and decide how money will be allocated over time. It involves setting financial goals, analyzing spending patterns and establishing guidelines that influence future decisions.

Through this ongoing process, individuals gain visibility into their finances and create a framework for controlling cash flow and reducing uncertainty levels overall.

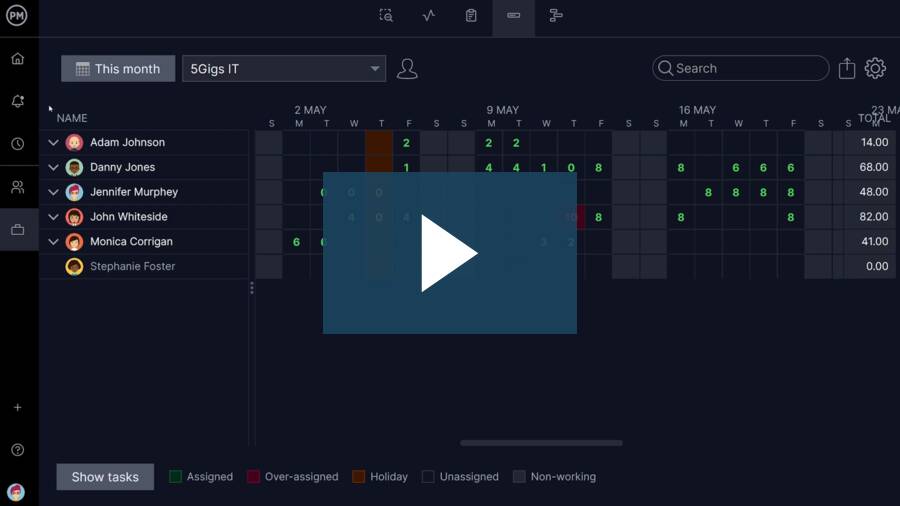

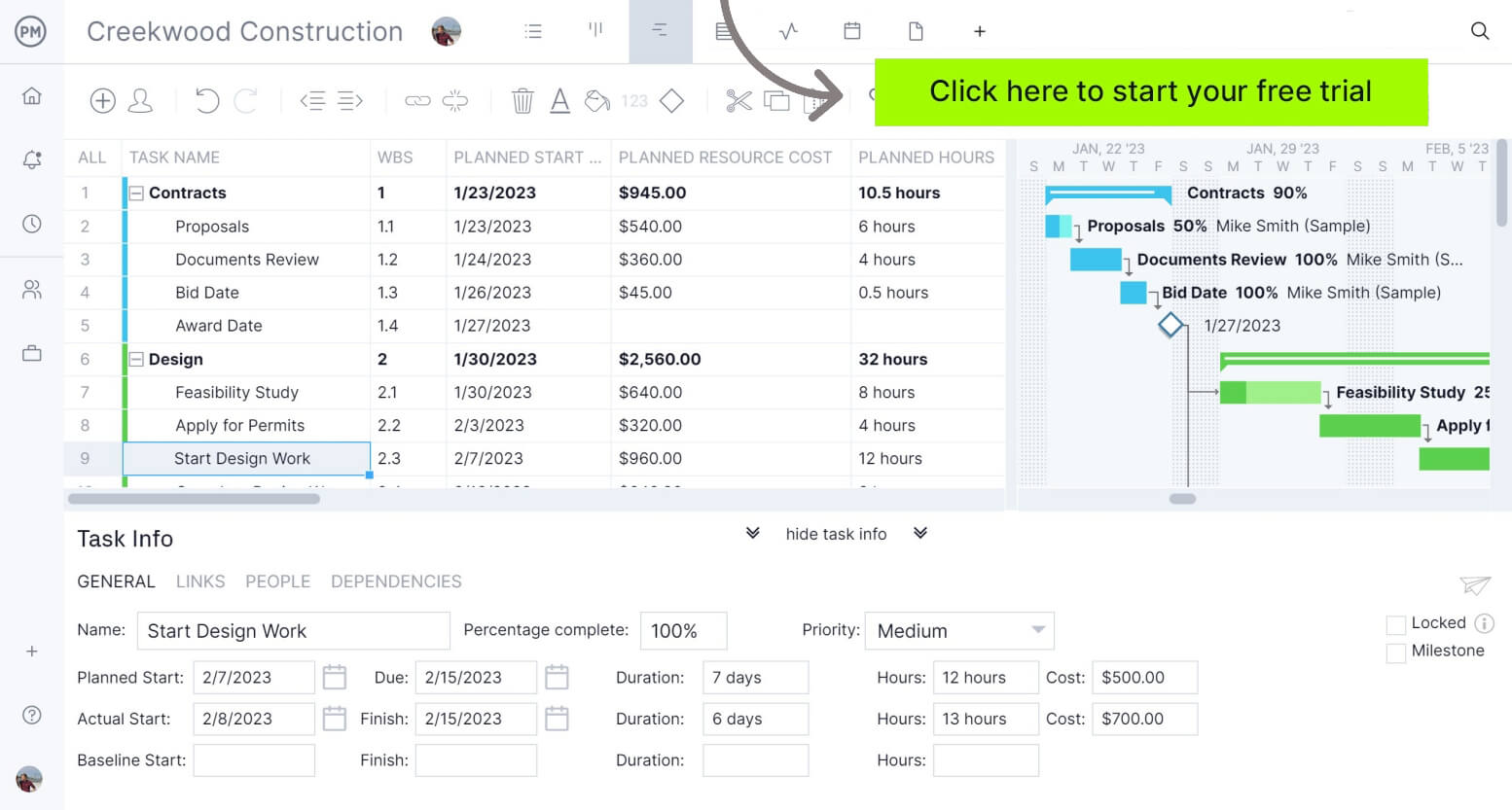

Budget planning doesn’t only apply to personal finances. To ensure project budget planning goes smoothly, you need the ability to track resources in one streamlined location. ProjectManager has resource management features that include timesheets, workload charts, planned vs. actual costs and more. Our tools help you estimate, organize, track and adjust project costs, all tied directly to your schedule and resources. Get started by taking a free 30-day trial, no credit card required.

What Is a Budget Plan?

A budget plan is a tangible financial document that captures projected income, planned expenses and savings targets in one organized view. Unlike the planning process itself, it serves as a reference point for tracking performance and making adjustments.

This document translates financial intentions into measurable figures, enabling clearer accountability, comparisons over time and more disciplined money management for individuals today.

When to Make a Budget Plan

Creating a budget plan becomes especially important during major life transitions, when financial priorities shift, responsibilities increase and unplanned decisions can quickly impact long-term stability and personal financial security.

- Starting a family introduces new recurring expenses, requiring clearer planning for childcare, healthcare and long-term household costs.

- Planning a wedding often involves large, time-bound expenses that demand structure to avoid debt and financial stress.

- Saving for college or education requires disciplined forecasting to balance current living costs with future tuition obligations.

- Buying a home increases financial complexity through mortgages, maintenance, taxes and shifting monthly cash flow needs.

- Changing careers or income levels makes budgeting essential for adapting spending habits to new financial realities.

How to Make a Budget Plan

Turning financial intentions into a usable budget plan requires deliberate choices, clear constraints and realistic assumptions that shape how money is distributed, monitored and adjusted over time.

1. Define the Budgeting Period

Before assigning any numbers, it’s essential to determine the timeframe the budget will cover. The length of the budgeting period directly affects spending decisions, priorities and flexibility. An amount that feels sufficient over a few days can become restrictive over several weeks. By defining whether the budget applies weekly, monthly or longer, individuals can align allocations with real-world consumption patterns and avoid distorted expectations.

2. Establish a Budget Amount

Once the budgeting period is clear, the next step is identifying how much money is actually available to work with. This figure should reflect existing funds rather than optimistic projections of income not yet received. Regardless of the budgeting method used, basing the budget amount on confirmed resources creates a more reliable plan. Doing so reduces risk, prevents overspending and ensures that financial decisions remain grounded in reality throughout the period.

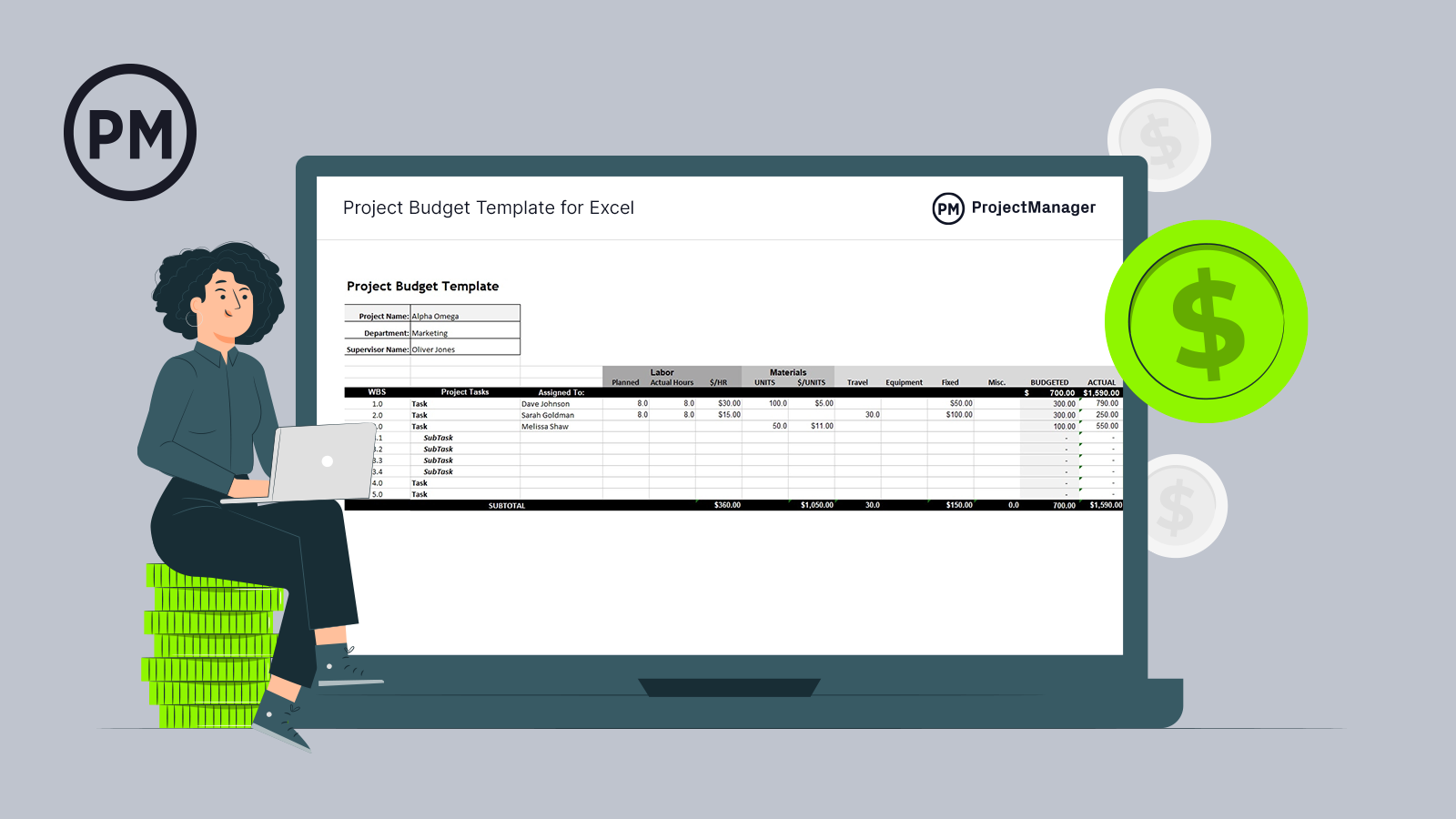

Get your free

Project Budget Template

Use this free Project Budget Template to manage your projects better.

3. Identify Expense & Income Categories

Grouping expenses into clear categories adds structure to a budget plan and prevents costs from blending into a single total. Categories make it easier to understand where money goes, highlight spending areas that consume a disproportionate share and reveal patterns that might otherwise be missed.

This clarity supports better judgment when adjustments are needed. Income categories may also be included when earnings come from multiple sources, though expense categorization remains the primary focus at this stage for accurate visibility and more informed future financial decisions throughout the budgeting period ahead.

4. Estimate Expenses and Allocate Funds

With categories defined, the next step is assigning estimated amounts to each expense for the selected budgeting period. These estimates should reflect realistic expectations based on typical spending habits. Once funds are allocated, the document becomes a functional budget plan. From here, actual expenses can be recorded alongside estimates and any income received during the period can be added, creating a working comparison that supports ongoing adjustments between planned targets and real financial activity over time for clarity and control.

Related: 18 Budget Templates for Business & Project Budgeting

5. Compare Estimates vs. Actual Expenses and Income

Reviewing estimates against actual expenses and income is what turns a budget plan into a useful management tool. This comparison reveals gaps between expectations and reality, showing where overspending occurs or where savings opportunities exist. It also helps validate assumptions made during planning.

By tracking variances consistently, individuals gain a clearer picture of their financial behavior, improve future forecasts and make informed adjustments that strengthen long-term financial control through regular reviews and disciplined documentation practices across different budgeting periods and goals.

Budget Plan Examples

Looking at real-world formats helps translate budgeting theory into something practical, showing how income can be organized, monitored and adjusted using a clear structure.

50/30/20 Budget Plan

The 50/30/20 budget plan is a simple method that divides after-tax income into three spending categories. Fifty percent is reserved for essential needs such as housing and utilities, 30 percent is allocated to discretionary wants and 20 percent is dedicated to savings or debt reduction. This approach offers flexibility while still enforcing limits, making it popular among individuals seeking a balance between lifestyle enjoyment and long-term financial stability.

John earns $3,000 per month after taxes and wants an easy way to manage his money. He assigns fixed dollar amounts to needs, wants and savings, then tracks spending weekly to avoid exceeding any category.

| Goal | Objective | Target Outcome | Monthly Amount ($) |

| Cover needs | Allocate 50% of income to essentials | Stable monthly living costs | $1,500 |

| Control wants | Limit discretionary spending to 30% | Reduced impulse purchases | $900 |

| Build security | Direct 20% toward savings or debt | Improved financial resilience | $600 |

Related: 50/30/20 Budget Template

70/20/10 Budget Plan

Designed around proportional allocation, the 70/20/10 budget plan divides income into three broad purposes. Seventy percent is used for living expenses and discretionary costs combined, 20 percent is reserved for savings or investments and 10 percent is directed toward debt repayment or financial goals. This model works well for individuals who prefer simplicity while still maintaining a disciplined approach to saving and reducing liabilities without tracking numerous expense categories.

Maria earns $4,000 per month after taxes and prefers a straightforward structure. She allocates most of her income to everyday expenses, commits a fixed portion to savings and uses the remainder to steadily reduce outstanding debt.

| Goal | Objective | Target Outcome | Monthly Amount ($) |

| Manage expenses | Allocate 70% to living and discretionary costs | Balanced lifestyle spending | $2,800 |

| Grow savings | Set aside 20% for savings or investments | Long-term financial growth | $800 |

| Reduce debt | Use 10% for debt or financial goals | Lower outstanding balances | $400 |

Zero-Based Budget Plan

The zero-based budget plan requires assigning every dollar of income a specific purpose until the remaining balance equals zero. Instead of leaving money unallocated, each expense, saving goal or debt payment is planned. This approach encourages intentional decision-making, minimizes waste and provides detailed visibility into spending behavior. It’s particularly effective for individuals who want tight control over cash flow and clear justification for every financial choice.

Daniel earns $3,500 per month and wants maximum control. At the beginning of each month, he assigns every dollar to bills, savings and personal spending so that nothing remains unplanned.

| Goal | Objective | Target Outcome | Monthly Amount ($) |

| Cover essentials | Assign funds to all fixed expenses | Bills paid on time | $2,200 |

| Plan savings | Allocate money to savings goals | Consistent monthly saving | $700 |

| Control spending | Assign remaining funds to discretionary use | No unaccounted expenses | $600 |

Flexible Budget Plan

Built to adapt as circumstances change, a flexible budget plan adjusts expense limits based on actual income or activity levels. Instead of fixed amounts, spending ranges shift when earnings rise or fall. This approach is especially useful for variable-income households, allowing essential costs to remain covered while discretionary spending expands or contracts. Flexibility reduces financial stress by keeping the budget realistic under changing conditions rather than forcing rigid limits that no longer match reality.

Sophia works in sales and her monthly income fluctuates. She sets baseline limits for necessities, then increases or reduces discretionary spending depending on commissions earned that month.

| Goal | Objective | Target Outcome | Monthly Amount ($) |

| Cover essentials | Maintain minimum spending for fixed costs | Financial stability | $2,000 |

| Adjust lifestyle | Scale discretionary spending with income | Controlled flexibility | $700–$1,200 |

| Protect savings | Preserve a consistent savings contribution | Long-term security | $500 |

Rolling Budget Plan

Rather than resetting annually, a rolling budget plan continuously extends the planning horizon as time passes. Each month or quarter, a new period is added while completed periods drop off. This keeps projections current and aligned with recent financial data. Rolling budgets improve responsiveness to change, making them ideal for individuals who want forward-looking visibility and ongoing refinement instead of static, outdated assumptions.

Kevin reviews his budget at the end of every month. As one month closes, he adds a new future month, updating projections using the latest spending and income data.

| Goal | Objective | Target Outcome | Monthly Amount ($) |

| Maintain accuracy | Update budget projections monthly | Current financial outlook | $3,200 |

| Plan ahead | Extend budget into future periods | Fewer surprises | $1,000 |

| Refine decisions | Adjust allocations using recent data | Smarter spending choices | $800 |

Free Budget Planning Templates

Spreadsheets remain the default choice for building a budget plan because Excel combines flexibility with precision. Users can adjust figures instantly, apply automated formulas and model different scenarios without rebuilding the document.

For this reason, ProjectManager provides free Excel budget planning templates that are interactive, customizable and designed to simplify ongoing financial tracking and updates over time for individuals everywhere.

50/30/20 Budget Plan Template

This 50/30/20 budget plan template divides income into needs, wants and savings, helping users balance essentials, lifestyle spending and long-term financial goals with simple percentages over a defined budgeting period.

Construction Budget Template

Use this construction budget template to capture all the tasks and their related costs so the general contractor can forecast the cost of the project. Use the template to compare what you’re actually spending to what you budgeted to help keep the project on track financially.

Budget Sheet Template

This budget sheet template tracks a starting budget, adds income, subtracts expenses and calculates a final balance, giving users a period-based view of financial activity for personal or small-business use.

Plan Project Budgets with ProjectManager

From assigning estimated costs for labor, materials and equipment to assigning resources with hourly rates on the Gantt chart, ProjectManager simplifies the budget planning process. Team members can log time on timesheets while dashboards display key budget data at a glance. You can also run and export reports on budget summaries, expense details and more.

Related Budgeting Content

- 18 Budget Templates for Business & Project Budgeting

- What Is a Business Budget? Business Budgeting Basics

- What Is an Operating Budget? Key Components

- What Is a Budget Report? Purpose, Components & Benefits

The post How to Make a Budget Plan for Personal Finance Management appeared first on ProjectManager.