Q3 hammered home a simple message to SaaS founders: capital is available if you’re AI-centric.

With AI attracting over half of global VC investment, the funding picture is much rosier for SaaS companies building differentiated AI-native or AI-enabled platforms. But non AI-focused SaaS companies face a shrinking investment pot and longer deal cycles.

Here’s your recap of the key SaaS deals, valuations and acquisitions from Q3, as well as analysis of AI’s ongoing impact on SaaS funding.

Q3 SaaS benchmarks

In September, Iconiq Capital’s State of Software 2025 report revealed top quartile benchmarks that VCs will judge you on when deciding to invest. They include:

- Net dollar retention: 121% for early-stage companies (<$100M)

- CAC payback: ~16 months

- Rule of 40: ~50%

- ARR growth:

-

- <$50M – 104%

- $50-100M – 77%

- $100-200M – 38%

- >$200M – 25%

Q3 VC funding

Venture funding in Q3 grew 38% year-on-year, hitting $97B. But a third of the entire venture pot went to just 18 (largely AI-related) companies, each of which attracted $500M+ deals.

For VC investors, the fear of missing out on AI’s potential clearly outweighs fears of an AI bubble. In the US, for example, PitchBook’s Venture Monitor showed that:

- AI companies attracted 64% of VC deal value in Q3 (up from 56% in Q3 2024), but only 37.5% of deal count.

- Unicorns dominated deal value with 56.8% of investment, yet just 2.7% of deal count.

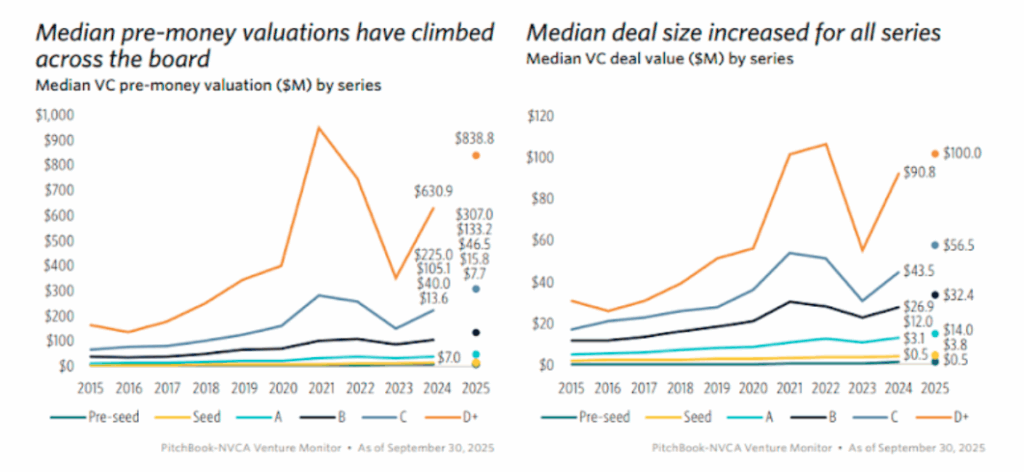

- VC deal sizes and pre-money valuations increased across the board from Seed to Series D, with the median Series C deal rising the most (by 30%).

VCs still have an appetite for smaller start-ups with sub-$5M deals accounting for half (50.3%) of all VC deals in 2025. However, this is a decade-long low and down from 57% in 2024, which indicates that:

a)Capital is out there, but it’s highly selective and highly concentrated.

b) Non AI-focused start-up founders should be trying to extend their runways and delay fundraising until a more friendly market appears.

Q3 AI SaaS funding

Investors have double downed on AI. According to Iconiq, AI funding ($377B) in the first half of 2025 surpassed the whole of 2024 ($363B) and the average deal size more than doubled from $17.2M to $35.9M.

While the Q3 headlines were grabbed by the AI megarounds (nine companies pulled in funding deals worth $1B+, including Anthropic’s $13B Series F), there was also a 10% QoQ/YoY rise in early-stage funding (totalling nearly $30B) with notable Series A and Series B rounds in the SaaS landscape. For example:

- Lovable – The AI-development platform became a unicorn with a $200M Series A.

- Attio – The AI-native CRM platform raised a $52M Series B.

- Fyxer.ai – The AI virtual assistant raised a $40M Series B (read how they closed the deal in just 20 days).

Unsurprisingly, the most sizeable SaaS deals in Q3 happened in the AI sphere and even non-AI native SaaS deals had AI front of mind. For example, maintenance and asset management software MaintainX’s $150M Series D was completed to “to expand its AI and machine health monitoring capabilities.”

Q3 SaaS IPOs, Valuations and M&A

IPOs

Tech companies – including AI, SaaS and digital infrastructure – helped the US IPO market issue 24% more IPOs in H1 2025 than the year before. In particular, Figma’s $1.2B IPO stood out as a beacon of SaaS popularity, with its stock price tripling after one day of trading (valuing the firm at nearly $68B).

The strong performance of tech IPOs should have a downstream effect on SaaS funding, giving VCs confidence for earlier rounds. However, not all start-up listings were as headline-grabbing as Figma and IPO activity remains in line with the last few years.

Valuations

For some investors, such as Bryan Yeo, group chief investment officer at Singapore sovereign wealth fund GIC, there’s a “hype bubble going on” with early-stage valuations. “Any company startup with an AI label will be valued right up there at huge multiples of whatever the small revenue (is).”

Meanwhile, Iconiq’s data found that:

- 4.5x is the current median public software revenue multiple.

- The Rule of 40 has become the strongest predictor of valuation – more than ARR or NRR.

- A 1-point increase in ARR growth has nearly 2x the impact on valuation compared to the same increase in cash flow margin.

M&A

While M&A dollar volume in Q3 fell QoQ from $43.6B to $27.5B, nine companies were acquired for over $1B in Q3 – three of which are SaaS companies.

- Software testing company Statsig was bought by OpenAI for $1.1B.

- Developer intelligence platform DX was purchased by Atlassian for $1B.

- Sana, which builds AI native platforms, was acquired by Workday for $1.1B.

The AI imperative

Despite fears of an AI bubble, investors are still going all-in on AI-native and AI-enabled SaaS companies.

What’s more, start-ups are currently spending big on AI applications to assist their human employees, with Andreessen Horowitz’ data showing 60% of their spend goes to horizontal AI platforms that boost company productivity.

From both a funding and competition perspective, embedding AI in your solution and processes is an imperative.

SaaStock Blueprint newsletter subscribers get this content first. Get on the list.